Is investing in residential real estate still a good bet?

As September settles in and fall edges around the corner, standing on the back deck sipping a seltzer, you may be wondering, is what you’re seeing online—more price cuts, a few stale listings, and a strong rental market—add up to opportunity or to a trap? Your social feeds say “crash.” Your spreadsheet says “maybe.” Your gut remembers 2008. Yet you also know people will keep needing places to live; the question is not whether housing will be used, but whether this house in this market, at this price and mortgage you are seeing, will pay its way over time.

We’re going to break down the factual pros and cons of investing in residential real estate today, and let you be the judge, including touching on what the One Big Beautiful Bill Act (H.R. 1) is doing for investors and an investment loan option that can open doors for some investors, and then wrap up with how to hunt value by city and an expert checklist of what to look for from your local market when investing.

What follows is a clear-eyed guide to investing in residential real estate generally, and specifically, in late 2025.

Let’s start with the elephant in the room: is real estate crashing?

When it comes to housing crash talk, YouTube often runs wild. But how often has it actually been right since its inception in 2005? Will talk about that shortly. Meanwhile, the national picture says no, not crash—but it has slowed.

- In August 2025, active listings rose 20.9% year over year, the 22nd straight month of inventory gains and the fourth month above one million active listings; homes spent a median 60 days on market (+7 y/y), and 20.3% of listings had a price cut.

- Realtor.com calls it a gradual rebalancing and notes the national market is roughly balanced at five months of supply. Realtor On the closed-sales tape, Redfin reports a U.S. median sale price of $443,462 (+1.4% y/y) with homes sold –2.3% y/y—a slowdown, not a rout.

- Mortgage rates have eased from 2024 peaks; the average 30-year fixed touched ~6.58% on Aug. 14, 2025 (low of the year), and then fell again to 6.35% on Sept. 11, 2025, which can wake up fall demand—though affordability is still tight. Freddie Mac+1

As a counterpoint to softening appreciation and valuation, it’s important to remember that the picture varies widely from market to market. Also, for every one-point drop in mortgage rates, roughly five million buyers enter the market. That kind of surge in demand can quickly drives up competition for what is still meager inventory compared with past, pre-pandemic levels.

This fact both quantifies and illustrates just how quickly the dynamics of supply and demand can shift.

Part I — Is The Market Stable?

No one wants to buy a lemon.

Many of us still carry the scars of the 2008 meltdown, which was both a loose banking law crisis and a morally corrupt ratings system. Banks began offering loans without verifying income or assets and requiring little or no down payment. Anyone with a pulse and an ID could get a loan. This flooded the market with buyers, much like prospectors heading west during the gold rush, seeking their fortune and driving up competition and values along the way. The result was a very unstable market hidden beneath false “A” paper ratings. When loans started defaulting, the housing market suffered.

To prevent this from ever happening again, the Ability-to-Repay/Qualified Mortgage (ATR/QM) rule was passed in 2010. It made it unlawful to fund a mortgage without first making a “reasonable, good-faith determination” of a consumer’s ability to repay. In practice, this meant documentation, verification, and a standardized set of underwriting factors.

The bottom line: ATR/QM removed the oxygen that fed the 2006–07 exotic lending bubble known as subprime, which is one reason broad delinquencies and foreclosures remain low today. (For a plain-English statutory summary, see the CFPB’s original rule brief.)

In the short term, regardless of future appreciation, most homeowners today can actually afford their homes. Before the bubble, it wasn’t uncommon to see restaurant workers making $36K a year owning five rental properties—often with no money down. Why not? All you needed was a signature at the bottom line, and even closing costs could be rolled in.

That changed in 2010, when ATR rules took effect. No longer would someone’s word, even a CPA’s, be enough. Since then, borrowers must demonstrate how the mortgage will be repaid—whether through income, assets, or a rent roll on residential investment property.

The result: the underpinnings of today’s real estate market looks very different from 2008.

It’s true that in recent years we’ve seen the return of more “creative” products, like the DSCR (Debt Service Coverage Ratio) loan. But these still follow the essential rule: proof of repayment via rents received, often with a larger down payment. That keeps the market far more stable than it was in 2008.

There’s also much more to understand about how today’s market differs from 2008: housing starts have not kept up with demand, demographics point to steady demand growth over the next decade, and the potential for lower rates in the next 12–24 months could further improve affordability and drive prices higher.

Stay tuned for our November post—it will be full of charts and graphs exploring the history of real estate dynamics in more detail.

What About the New Tax Benefits with OBBA – Does It Help InVestors Today?

In July 2025, Congress enacted the One Big Beautiful Bill Act (H.R. 1).

Among its business provisions, Section 70301 makes permanent 100% bonus depreciation under IRC §168(k) and sets effective dates tied to acquisition on or after Jan. 19, 2025 (with a one-time election allowing reduced percentages for assets placed in service in the first taxable year ending after that date). Congress.gov

This does mean you will need to have a cost segregation completed—which needs to be completed by a professional. In the process, components that typically get depreciated in 20 years or as few as five, such as appliances, dedicated electrical, certain cabinets/finishes can be deducted in the first year, and site/land improvements like fencing or paving from the 27.5-year depreciation can be moved to the 5-, 7-, or 15-year classes. The IRS’s Cost Segregation ATG sets the classification logic and defines “residential rental property” (27.5-year GDS; 80% of gross rental income from dwelling units). Day-to-day rental rules (depreciation, passive loss limits, recordkeeping) are in Publication 527, for your reference.

What does this mean in practical terms? – If you can offset a tax bill or at least what you owe on your Schedule E income, you don’t have to wait.

Just a note as not to be confused with commercial property:

• QIP, “Qualified improvement property,” are not residential by statute; residential interior work does not become QIP just because it’s “interior.” Acceleration in rentals comes only from bona fide residential property and land improvements identified in a cost segregation for residential property.

Practical Upshot:

2025 is unusually friendly to front-loading depreciation on rentals—if the fundamentals pencil first. Cost segregation amplifies a good deal; it won’t rescue a bad one. So, read on about markets and what to look for if the tax break sounds appealing. (For a current, plain-English policy read, see Tax Foundation’s September analysis.) Tax Foundation

Part II —Where Value Lives in 2025 (and How to Find It)

Housing Cycles – is it still a long-duration asset?

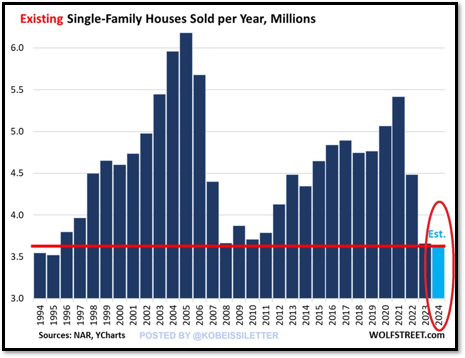

Harvard’s State of the Nation’s Housing 2025 notes sales running at the lowest level since the mid-1990s, with insurance premiums and property taxes pressuring owners and renters. That’s a mature, affordability-constrained cycle—not a systemic breakdown.

Note this chart of what happens when volume contrains, often due to market fluctuations, affordability or qualification issues for a period of time (and what that means about where we are today):

For those worried they may have missed the window to invest, this graphic tells a very different story. It’s worth repeating: over the past 78 years, the housing market has declined only seven times. Yes, average appreciation fluctuates, but over the long term it settles at about 4.1% annually.

Even with the exceptional growth of the past five years, the average still comes in at 5.98%. That may sound surprising, but the numbers don’t lie.

The takeaway? It’s far more important to buy smart than to get caught up in short-term trends.

Dealing with Social Media – Staying Grounded Amid the Algorithm Mayhem

Online success metrics are driven by clicks, not accuracy, and algorithms are optimized accordingly. A massive headline experiment showed that negativity pays: each additional negative word boosted click-through by 2.3%. When moral-emotional words were added, results jumped by about 20% per word. And research confirms that false news spreads “farther, faster, deeper, and more broadly” than truth. No wonder alarm outperforms truth online.

Your advantage? You can operate from meta-level data—a topic we’ll explore in depth this November. For now, anchor yourself to the fundamentals: metro data (inventory, days on market, price cuts, closings), pipelines (permits and starts), operating costs (taxes and insurance), and your own debt service.

Now, if you are still interested in investing, let’s look at a checklist to help you evaluate markets you’re considering, and see if they pass the litmus test.

The Investor’s Field Checklist (use this before you write an offer)

Three Things to Carry With You

Whether you’re ready to move forward or feel now isn’t the right time, as a homeowner you’ll likely be interested in November’s blog post—a deep dive into the context for today’s real estate market and how to interpret what is happening in terms of what the future may hold. Until then – here’s three takeaways:

![]()

Need help with or mortgage or have mortgage related questions?

- At Ritter Mortgage, we are here to help you navigate all your homeownership needs and concerns. If we can answer questions or be of service, please don’t hesitate to reach out: 410-795-8900.

Works Cited (MLA 9)

Angrisani, Marco, et al. “The Effect of Housing Wealth Losses on Spending in the Great Recession.” SSM—Population Health, 2018.

Brady, William J., et al. “Emotion Shapes the Diffusion of Moralized Content in Social Networks.” PNAS, vol. 114, no. 28, 2017, pp. 7313–7318.

Consumer Financial Protection Bureau. “Ability-to-Repay/Qualified Mortgage Rule.” 22 Oct. 2021.

—. “Summary of the Ability-to-Repay and Qualified Mortgage Rule.” Jan. 2013.

Federal Housing Finance Agency. “FHFA House Price Index® Down 0.2 Percent in May; Up 2.8 Percent from Last Year.” 29 July 2025.

Federal Reserve History. “The Great Recession and Its Aftermath.”

Freddie Mac. “Mortgage Rates Continue to Decline.” News Release, 14 Aug. 2025. Freddie Mac

Freddie Mac. “Primary Mortgage Market Survey (PMMS).” 11 Sept. 2025. Freddie Mac

Harvard Joint Center for Housing Studies. The State of the Nation’s Housing 2025. 2025.

Internal Revenue Service. Cost Segregation Audit Techniques Guide (Pub. 5653).

—. Publication 527: Residential Rental Property (2024).

Jones, Hannah. “Weekly Housing Trends: Latest Data as of Sept. 6.” Realtor.com, 11 Sept. 2025. Realtor

Mortgage Bankers Association. “Mortgage Applications Increase in Latest MBA Weekly Survey.” 10 Sept. 2025. MBA

O’Brien, Kim. “Big Apartment Markets with the Most Concessions in August.” RealPage Analytics, 9 Sept. 2025. RealPage

Apartment List Research. “National Rent Report.” 27 Aug. 2025. Apartment List

Redfin Data Center. “United States Housing Market & Prices.” Accessed 12 Sept. 2025. Redfin

Krimmel, Jake. “August 2025 Monthly Housing Market Trends Report.” Realtor.com Research, 8 Sept. 2025. Realtor

Tax Foundation. “Property Taxes by State and County, 2025.” 4 Mar. 2025.

Tax Foundation. “One Big Beautiful Bill | Corporate Tax Changes.” 4 Sept. 2025. Tax Foundation

U.S. Census Bureau / HUD. “New Residential Construction: June 2025.” 18 July 2025.

United States, Congress. One Big Beautiful Bill Act, H.R. 1, 119th Cong., 2025. (See §70301 on §168(k) bonus depreciation; Public Law 119-21, July 4, 2025). Congress.gov